Table of Contents

Introduction: Cryptocurrency Wallets for Beginners

If you’re new to cryptocurrencies, one of the first things you’ll need to understand is how to store and manage your digital assets securely. Unlike traditional money, cryptocurrencies like Bitcoin and Ethereum aren’t stored in banks—they require a cryptocurrency wallet. But don’t worry, the concept isn’t as complicated as it might sound!

A cryptocurrency wallet is your gateway to managing your digital funds. It’s where you store the private keys that give you access to your assets and enable transactions. Choosing the right wallet and understanding how it works is essential for protecting your investments and ensuring peace of mind.

In this guide, we’ll explore the basics of cryptocurrency wallets for beginners, from the different types available to the best practices for securing them. Whether you’re looking to trade frequently or store your assets long-term, you’ll gain the knowledge you need to make smart, secure decisions. Let’s dive in!

What Are Cryptocurrency Wallets?

Cryptocurrency wallets are an essential part of managing and securing your digital assets. They serve as the digital equivalent of a physical wallet, but instead of holding cash or cards, they store the cryptographic keys that give you access to your cryptocurrencies.

Definition: A Digital Tool for Storing and Managing Cryptocurrencies

A cryptocurrency wallet is a software or hardware tool that enables you to store, send, and receive cryptocurrencies like Bitcoin, Ethereum, and others. Unlike physical wallets, these wallets don’t store the actual coins; instead, they hold the private keys required to access your funds on the blockchain.

How They Work

- Private Keys and Public Keys:

- Each wallet generates a pair of cryptographic keys: a private key and a public key.

- The public key acts as your wallet address, which others can use to send cryptocurrency to you.

- The private key is like a password—it’s used to access and manage your funds.

- Blockchain Interaction:

- When you initiate a transaction, your wallet signs it using your private key, proving ownership of the funds.

- The transaction is then broadcast to the blockchain network for verification and inclusion in the ledger.

Importance of Cryptocurrency Wallets

- Secure Asset Management:

- Without a wallet, you can’t securely store or transfer your cryptocurrency. Exchanges and custodial wallets are convenient but carry risks, such as hacking or loss of access.

- Ownership and Control:

- A non-custodial wallet gives you full control of your private keys, ensuring that you own your assets outright.

- Protection Against Hacks:

- By using a secure wallet, especially a hardware wallet, you can reduce the risk of cyberattacks and unauthorized access.

Cryptocurrency wallets are the foundation of digital asset management, providing both security and accessibility. Understanding how they work and why they’re important is the first step in safeguarding your investments and navigating the world of crypto with confidence.

Types of Cryptocurrency Wallets

Cryptocurrency wallets come in various forms, each designed to cater to different needs and levels of security. Choosing the right wallet depends on how you plan to use and store your digital assets. Here’s a breakdown of the most common types of cryptocurrency wallets:

1. Hot Wallets (Online Wallets)

Hot wallets are connected to the internet and are ideal for users who need quick and frequent access to their cryptocurrency.

- Examples:

- MetaMask: Popular for Ethereum-based tokens and decentralized applications (dApps).

- Trust Wallet: Supports multiple cryptocurrencies and integrates with DeFi platforms.

- Pros:

- Convenient for trading, transactions, and interacting with dApps.

- Easy to set up and use, making them suitable for beginners.

- Cons:

- Increased vulnerability to hacking and phishing attacks due to constant internet connectivity.

- Reliance on software security measures.

2. Cold Wallets (Offline Wallets)

Cold wallets are not connected to the internet, making them the most secure option for storing cryptocurrencies long-term.

- Examples:

- Ledger Nano X: A popular hardware wallet with Bluetooth connectivity.

- Trezor Model T: Offers top-notch security and a user-friendly interface.

- Pros:

- Highly secure against online threats like hacking or malware.

- Ideal for long-term storage of significant amounts of cryptocurrency.

- Cons:

- Less convenient for frequent transactions.

- Initial cost for purchasing a hardware wallet can be higher.

3. Paper Wallets

A paper wallet involves printing your private and public keys on a piece of paper, providing a completely offline storage solution.

- How It Works:

- Keys are generated using a secure offline tool and printed as a QR code or text.

- Pros:

- Immune to hacking, as it is entirely offline.

- Simple and cost-effective option for cold storage.

- Cons:

- Easily lost, damaged, or destroyed, making it less reliable for long-term use.

- Difficult to use for frequent transactions.

4. Custodial Wallets

Custodial wallets are managed by third-party services, such as cryptocurrency exchanges or platforms, where the service provider holds your private keys.

- Examples:

- Coinbase Wallet: Offers both exchange services and a user-friendly wallet interface.

- Binance Wallet: Integrated with the Binance exchange for easy trading.

- Pros:

- Beginner-friendly and easy to use.

- Often integrated with exchanges for seamless trading.

- Cons:

- Lack of control over your private keys, meaning the provider technically owns your funds.

- Dependence on the platform’s security measures, which could fail in case of a breach.

Understanding these wallet types and their pros and cons will help you choose the best option for your needs while safeguarding your digital assets.

How to Choose the Right Wallet

Selecting the right cryptocurrency wallet is a crucial step in safeguarding your digital assets. The best wallet for you depends on your specific needs, level of experience, and security preferences. Here’s a step-by-step guide to help you make the right choice:

1. Consider Your Needs: Frequent Trading vs. Long-Term Storage

Your intended use of cryptocurrencies will largely determine the type of wallet you need.

- Frequent Trading:

- If you’re a trader or plan to make regular transactions, a hot wallet is the most convenient option.

- Example: MetaMask or Trust Wallet allows fast access and seamless transactions.

- Long-Term Storage:

- For long-term investors who rarely move their funds, a cold wallet like Ledger or Trezor is ideal for enhanced security.

- Example: Storing Bitcoin or Ethereum for years to benefit from long-term value appreciation.

2. Evaluate Security Features

Security should be a top priority when choosing a wallet. Look for these features:

- Two-Factor Authentication (2FA):

- Adds an extra layer of security by requiring a second step (e.g., a code from your phone) to access the wallet.

- Biometric Access:

- Some wallets support fingerprint or facial recognition for secure login.

- Backup and Recovery Options:

- Wallets with clear backup processes, such as seed phrases, make it easier to recover funds if access is lost.

- Open-Source Code:

- Open-source wallets allow the community to review and verify their security, adding transparency and trust.

3. Check Compatibility

Not all wallets support every cryptocurrency. Ensure the wallet you choose is compatible with the coins you plan to store.

- Multi-Currency Support:

- If you hold multiple cryptocurrencies, look for a wallet that supports a wide range of coins.

- Example: Trust Wallet and Exodus Wallet handle multiple assets in one place.

- Blockchain-Specific Wallets:

- For users focused on a single blockchain, consider a wallet specifically designed for that ecosystem.

- Example: SolFlare for Solana or Yoroi for Cardano.

Additional Tips for Choosing the Right Wallet

- User Experience:

- Ensure the wallet has an intuitive interface, especially if you’re a beginner.

- Reputation:

- Research reviews and community feedback to ensure the wallet is reliable and secure.

- Customer Support:

- Opt for wallets with responsive customer service for assistance in case of issues.

Choosing the right wallet is about balancing convenience, security, and compatibility with your needs. Whether you’re trading actively or holding assets for the long term, understanding your priorities and evaluating wallet features will help you protect your cryptocurrencies effectively.

Common Crypto Wallet Security Tips

Securing your cryptocurrency wallet is essential to protecting your digital assets. As cryptocurrencies operate in a decentralized environment, the responsibility for wallet security lies entirely with you. Here are some practical tips to keep your wallet safe from potential threats:

1. Backup Your Wallet

A lost private key or recovery phrase means permanent loss of access to your funds.

- How to Backup:

- Store your recovery phrases and private keys in a secure, offline location, such as a locked safe.

- Avoid storing backups on cloud services or devices connected to the internet, as they are vulnerable to hacking.

- Pro Tip:

- Create multiple copies of your backup and store them in different secure locations for redundancy.

2. Use Two-Factor Authentication (2FA)

Adding a second layer of security can make it significantly harder for unauthorized users to access your wallet.

- How 2FA Works:

- Requires a secondary form of verification, such as a code sent to your phone or generated by an app like Google Authenticator.

- Why It’s Important:

- Even if someone has your wallet password, they can’t access your funds without the 2FA code.

3. Beware of Phishing Attacks

Phishing is a common tactic used by scammers to steal your wallet credentials.

- How to Avoid Phishing:

- Never click on unsolicited links or emails claiming to be from wallet providers or exchanges.

- Always verify the website URL before entering any credentials.

- Pro Tip:

- Bookmark the official wallet provider’s website to avoid accidentally visiting fake ones.

4. Regularly Update Software

Outdated software can have vulnerabilities that hackers exploit.

- What to Update:

- Wallet apps, device operating systems, and any associated tools.

- Why It’s Important:

- Updates often include patches for security flaws and improved functionality.

5. Avoid Public Wi-Fi for Transactions

Public Wi-Fi networks are often unsecured, making them a target for hackers.

- Risks of Public Wi-Fi:

- Data interception, including wallet credentials and private keys.

- Safe Practice:

- Use a secure, private network or a virtual private network (VPN) when accessing your wallet or performing transactions.

Crypto wallet security requires diligence and proactive measures. By following these tips—backing up your wallet, using 2FA, avoiding phishing scams, keeping software updated, and steering clear of public Wi-Fi—you can significantly reduce the risk of losing your assets. Remember, in the crypto world, your security is your responsibility. Stay vigilant!

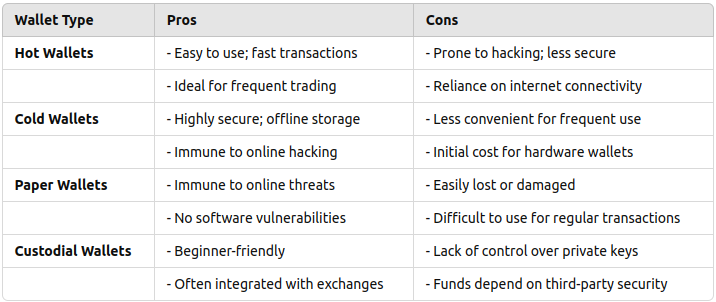

Pros and Cons of Different Wallet Types

When choosing a cryptocurrency wallet, it’s important to weigh the pros and cons of each type to determine which one best suits your needs. Here’s a quick overview of the advantages and disadvantages of the most common wallet types:

Key Takeaways

- Hot Wallets: Best for active traders or those who frequently transact with cryptocurrencies but carry a higher risk of online attacks.

- Cold Wallets: Ideal for long-term investors prioritizing security over convenience.

- Paper Wallets: A cost-effective option for offline storage, but not suitable for beginners or frequent use.

- Custodial Wallets: Great for beginners due to ease of use, but you sacrifice control over your private keys.

Understanding the strengths and weaknesses of each wallet type will help you choose the right one based on your trading habits, security needs, and experience level.

Conclusion: Cryptocurrency Wallets for Beginners

Understanding and managing cryptocurrency wallets is fundamental to securing your digital assets. Whether you’re a beginner or an experienced investor, selecting the right wallet type and following best practices for security are crucial steps in protecting your investments.

Hot wallets offer convenience for frequent trading, while cold wallets provide robust security for long-term storage. Paper wallets are a cost-effective offline option, and custodial wallets are a user-friendly choice for beginners, though they come with trade-offs in control.

By carefully evaluating your needs, prioritizing security features, and staying vigilant against threats, you can confidently manage your cryptocurrency holdings. Remember, in the decentralized world of crypto, the responsibility for safeguarding your assets lies entirely with you. Make informed decisions and take proactive measures to ensure the safety of your digital investments.

Disclaimer

The information provided in this article is for educational purposes only and should not be considered as financial, investment, or legal advice. Cryptocurrency wallets and security practices vary, and it is essential to conduct your own research and consult with a professional before making any decisions regarding your digital assets.

While every effort has been made to ensure the accuracy of the information, the author and publisher are not responsible for any losses, damages, or errors resulting from the use of this content. Always use caution, prioritize security, and understand the risks associated with managing cryptocurrency wallets. Use this information at your own discretion and responsibility.